If you have ever had to take your dog to the vet for an emergency, you know better than most how quickly those bills stack up. Pet insurance is usually a great way to insulate yourself against these unforeseen costs. However, you may not always get your money’s worth with these plans.

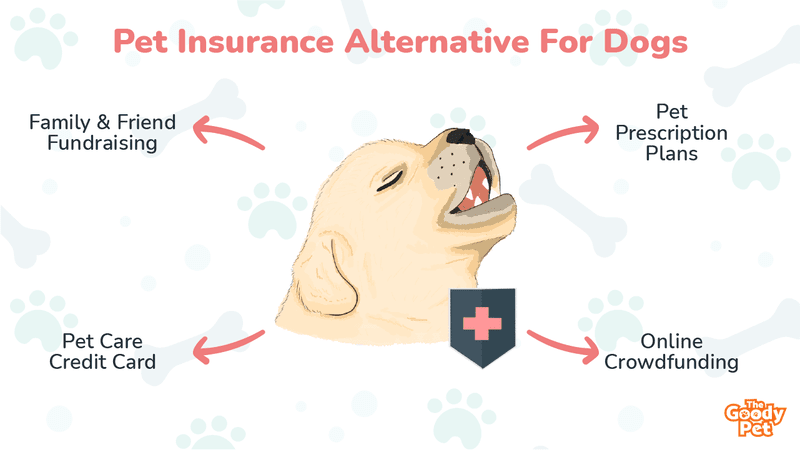

Fortunately, there are plenty of pocket-friendly alternatives that won’t compromise your dog’s well-being. These include options, such as pet care credit cards, pet prescription plans with vets, and emergency funds like Pawp.

In the sections below, we shall highlight eight alternatives to pet insurance that will give you your money’s worth.

8. Fundraising From Friends And Family

Fundraising from close contacts is probably the most natural step to take in case of serious medical emergencies involving your dog. It works best when the people you are asking for help from already have an emotional attachment to the pet and are invested in their well-being.

Fundraising from friends and family is an option worth considering for smaller vet bills where you just need a bit of help to clear any arrears arising from the dog’s care.

7. Personal Savings

If you don’t have friends or family, you feel comfortable asking for help from, using savings to fund veterinary care for your pet is an option worth considering.

It is imperative that you establish a separate and specific savings account. This will serve as a contingency plan in case your dog requires emergency vet care or even for basic services like deworming.

If you have the income to spare, start saving as soon as you get the dog in your care. That couple of bucks here and there will come in handy one day.

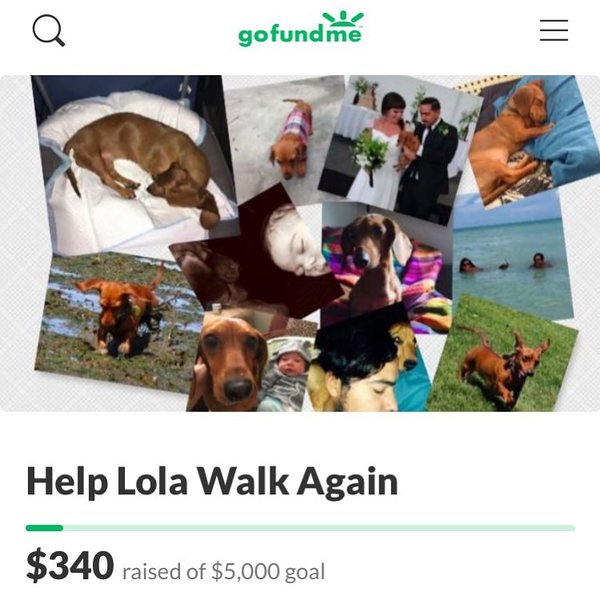

6. Online Crowdfunding

Online crowdfunding is becoming more and more popular these days, whether it is fundraising for education needs or for help starting businesses. It is also a fantastic alternative to pet insurance if you need help raising money in a short amount of time.

While these pleas are not always successful for everyone, it is an avenue worth considering in dire situations where you may not have any alternatives. Online crowdfunding may come in particularly handy for very large vet bills.

5. Community Sharing Plans

Sharing is caring, and the dog-lovers community is one that lives by this philosophy. Community sharing plans for pet care could come in particularly handy if you want a more pocket-friendly alternative to pet insurance.

Like pet insurance, a lot of these plans will require a regular contribution. However, the contributions are typically smaller than most insurance premiums. There are also fewer restrictions on what emergency services can be covered.

Just look up pet care community sharing plans in your area and join one that you feel fits your needs and goals.

4. Credit Plans With Vets

If you have a great rapport with your vet, you may be able to get a credit plan to serve as an alternative to pet insurance. In these cases, the vet agrees to offer services to your dog when needed, after which you can play slowly in installments.

Sometimes all you have to do is ask as many vets understand enough, especially in cases where the dog requires urgent emergency care for life-threatening health issues.

3. Pet Care Credit Card

There are some credit companies that offer special credit lines to help with emergency pet needs. These offer you all the cool perks of pet insurance without sticking you with unnecessary monthly costs.

With these credit cards, you can comfortably pay for your dog’s emergency veterinary care bills as well as for non-emergency services. After this, you will have time to pay off the credit as your dog recovers.

With the right line of credit for pet care, you can rest assured that you won’t be caught off guard.

2. Pet Prescription Plans

Pet prescription plans are arrangements between veterinarians and their clients where the latter enjoy significant discounts on different services and drugs that the dog may need.

This is particularly useful for covering medications your dog needs and can even get you these life-saving drugs at wholesale prices.

Pet prescription plans are similar to pet insurance in that there are monthly or annual payments to renew the prescription. However, pet prescriptions are usually more affordable. They also do not discriminate coverage based on pre-existing conditions that the dog may have.

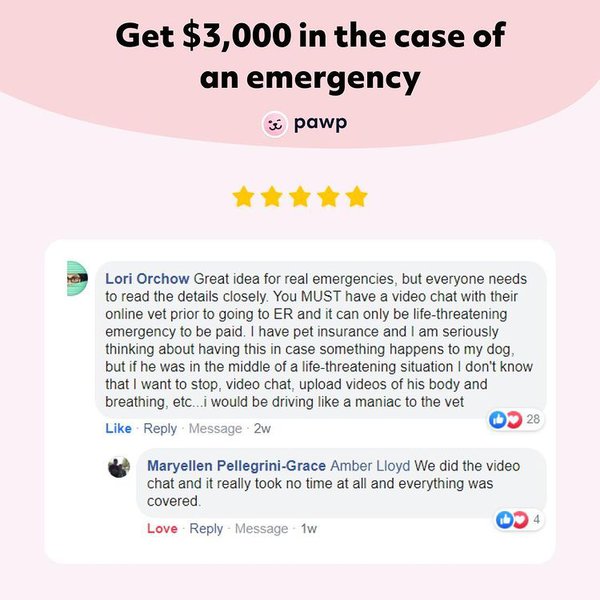

1. Organized Emergency Funding

There are several organizations that exist specifically to offer emergency funding for pet emergencies. Most offer this service at a small monthly fee and offer way more value for your buck than any pet insurance company ever could.

Pawp is a fantastic example in this case. For a mere $24 per month, you get free consultation for emergency and non-emergency services for up to 6 dogs. This emergency fund will also come in handy for emergencies that require intervention and will cover as much as $3,000.

Related Questions

What Are 4 Factors That Go Into Determining Your Monthly Premium For Pet Insurance? The four key factors that determine the monthly premium you have to pay on your pet insurance are:

- Breed

- Age

- Location

- Services covered

The age and breed determine the conditions that the dog is prone to discover with older dogs and sickly breeds requiring higher premiums. The location influences the average price ranges. Finally, the more services you want to be covered by the pet insurance, the higher your premiums will become.

Does Pet Insurance Pay For Vaccinations? Pet insurance does not typically cover vaccination. This exemption also goes for other non-compulsory services like spaying, neutering, grooming, deworming, and controversial procedures, such as tail-docking or declawing. For the most part, most pet insurance covers emergency care and medical and surgical intervention for non-preexisting conditions in the dog.

What Percentage Of Pet Owners Have Pet Insurance? According to a survey done in 2020 by MetLife, only 3% of pet owners in the United States use pet insurance which accounts for a little under 3 million pet owners. This figure is considerably low, but it is an upward trend compared to the previous years. The high premiums and strict requirements are commonly cited by other pet owners as the main reasons they avoid pet insurance.